Mixed Development – Can Huat More?

In today’s blog, I am going to talk about mixed development. I assume most of you will know what is mixed development or some call it integrated development. In the past years. We have some very exciting mixed development been put up for sale. Most recently, we have The Reserve Residences in the Beauty World area. If you can recall, Reserve received an overwhelming response from buyers. Not forgetting. We also have Pasir Ris 8 which was located next to Pasir Ris MRT station. It witnesses an impressive 85% take-up on the first weekend.

Some of you have asked me to do a video on this segment. Here, I will study 3 mixed developments and compare them with their surrounding condos that were launched almost at the same time. So that our comparison can be meaningful. Take note, this may not be the best way to compare as you know there are a lot of different conditions I need to factor in. But I think this is the least I can do to compare their performance on an Apple-to-apple basic.

Without further ado. Let go!

The Poiz Residences

The first mixed development we are going to study is The Poiz Residences. This is a 731-unit development with a retail mall on the ground floor. Location wise. It is right above Potor Pasir MRT station. It is on 99 years lease and TOP in 2018.

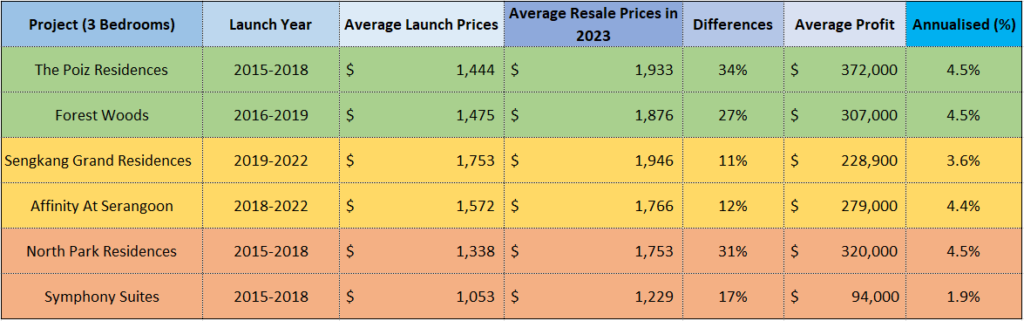

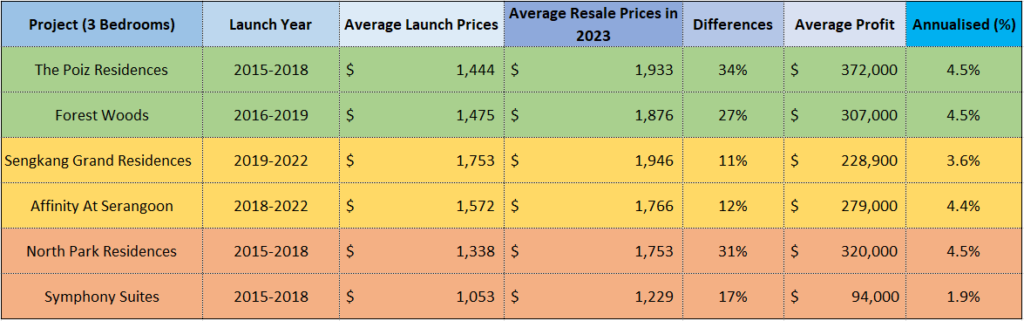

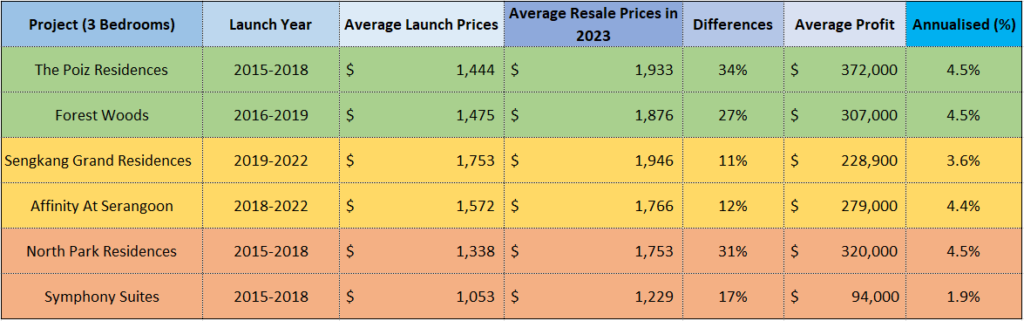

For our study. I will only select 3 bedrooms data for comparison so that our numbers can be consistent across all properties. Poiz was launched between 2015 to 2018. I have averaged out the 3 bedroom transactions over this period and the average price is $1,444psf. Similarly, I averaged out the 3-bedroom transaction in 2023 and the average psf is $1,933psf. This means this is a 34% difference.

Does it make any sense to you here? Definitely not. Let us compare another comparable property to have some perspective.

Forest Woods is located further upwards along the North-East line and the nearest MRT station in Serangoon MRT station. It is also on 99 years lease and there are 519 units. It TOP in 2020.

Forestwood was launched between 2016 to 2019. This is not too far off from Poiz Residences. Its average launch price was $1,475psf. Subsequently, the prices have increased to $1,876psf in 2023. This means this is a 27% difference. Can we safely say that Poiz outperforms Forest Woods?

To the layman. Maybe it is a big yes. But to me. I very meticulous one. I will dive a little deeper into it.

The average profit for Poiz for the 3 bedrooms is $372,000. Whereas, Forest Woods gain $307,000 instead. Does this mean Poiz achieves a better return?

Here, what I can only say is the timing of the purchase, the date of the sale, the size and layout of the property, and the various attributes of the development may affect its respective performances.

Hence, let us compare them on an annualized basis to account for the time horizon. This will give us a fairer way to analyze each property. Both Poiz and Forest Woods surprisingly achieved a similar analysis return at 4.5%. This shows that their performances are on par.

Sengkang Grand Residences

The second mixed development is Sengkang Grand Residences. This is a 680-unit development with a retail mall on the lower floors and also a hawker center. It is also conveniently located near Buangkok MRT Station and Buangkok Bus Interchange. It is on 99 99-year lease and TOP this year.

Sengkang Grand was launched between 2019 to 2022. The average price for 3 bedrooms is $1,753psf. Back then, this was considered very high for a Sengkang address. Today, there are not many resale transactions for the 3 bedrooms. So far, the only unit that measures 936sqf was sold for $1,946psf. This means the seller makes a decent $228,000 profit after holding it for 4 years. This translates to an annualized return of 3.6%. Anyway, let us use this sole transaction for our study.

Let me compare it against Affinity at Serangoon. It is located along Serangoon North Avenue 1 and comprises 1,012 condo units. It was launched almost the same time as Sengkang Grand. Its average launch price was $1,572psf. Today in 2023, prices have increased to $1,766psf. This means this is a 12% difference.

This is almost similar to Sengkang Grand. However, if we compare against the average profit. Sengkang Grand achieved an average profit of $228,000. There are some differences here due to the sizes and such. Anyway, Affinity achieved $279,000 in profit.

In terms of annalized returns. Affinity did better at 4.4% against Sengkang Grand at 3.6%. What does all this mean? Well, it means Affinity’s prices were lower when it was initially launched. Sengkang Grand prices were $200psf higher to account for its integrated development appeal.

However, one must also note that the upcoming Serangoon North MRT station that was announced later in 2019 would have benefited owners in Affinity. Especially so for those who bought before the announcement.

North Park Residences

The last mixed development we are going to study is North Park Residences. This is a 920-unit development with a retail mall on the lower floors and integrated with Yishun Bus interchange. It is located along Yishun Central 1 and link to Yishun MRT station. It is on 99 years lease and TOP in 2018.

North Park was launched between 2015 to 2018. The average price for 3 bedrooms is $1,338psf. Back then, this was considered very high in Yishun locality. I can still recall you can get a freehold condo such as The Calrose in Lentor for $1,100psf back in those days. Side track here.

Let’s assume if you have bought Calrose instead. What will be your return today? The average price in 2015 was $1,142psf for a typical 3 bedroom. Today, it should be around $1,700psf. This means this is a 49% difference. Impressive return in just 8 years.

Back to North Park, the average resale price is $1,753psf or a 31% difference.

Here, let me compare it against Symphony Suites along Yishun Close. It is on 99 years lease and comprises 660 units. It TOP in 2018. It was launched almost the same time as North Park. But they are a way apart. Why? Let us look into the numbers. Its average launch price was $1,053psf. Today price is hovering around $1,229psf. This mean price has increased by 17%.

If we compare against North Park. North Park sales performance seem to be doing better. It makes an average of $320,000 as compared to Symphony at a pathetic $94,000 over the years. If we break it up into annualized returns. North Park did an impressive 4.5% which is very decent as compared to Symphony’s 1.9%. Which in my opinion has barely breakeven with a small humble profit.

Why is this so. I look further and realize that the 3 bedrooms measure 73 to 85 sqm. I mean this is too small for comfort especially Big Brother HDB flats are typically 93sqm in size. This also explains why North Park outperforms.

Lesson learned! Don’t buy into something you wouldn’t want to stay for yourself. This is simple logic.

Conclusion

In conclusion, based on the above data. There doesn’t seem to be any distinctive advantage for a mixed development to be making more money than a typical condo based on the annualized return. Yes. One may argue that you have that extra convenience of staying above a mall. Well. That also means a premium price you need to pay. But that doesn’t translate to better profit when it hits the resale market.

So next time you invest in any mixed development. A good rule of thumb is to look at both the new launch prices and the surrounding resale in the vicinity. Study them well. Ask yourself does it make sense to you? Who knows? Buying a resale condo just like Calrose may be a better bet instead.

Anyway, there will be another exciting mixed development in Tampines come 2024. This site was sold to UOL, SingLand and CapitaLand consortium which submits the highest bid of $885 psf ppr for this GLS site. At such prices. This is what I call lao sao prices if we compare it against the last few GLS sites that are already trending at $1,200psf.

Here, what will be the future selling price since the developer’s breakeven is $1,661psf. Will it be selling at $2,300 or $2,400psf? Seriously, I don’t know. I only know is that when they buy this site at such cheap prices. They already huat half the way.

That all. Hope you enjoy this blog once again. Any comments? Feel free to comment in the description below. See you soon.