7 Common Mistakes That Property Investors Made In 2023

As we come towards the end of the year. I start to ponder what had happened in 2023.

This includes higher ABSD for higher-value properties. A higher land cost translates to higher selling prices. More million-dollar HDB flats. A new classification of BTOs flats from standard, plus to prime. Higher interest rate for most homeowners. And lastly, higher property tax for all residential properties.

At the same time, I also realize there are mistakes made by property investors. Be it buying or selling. In today’s video, I will discuss the top 7 common mistakes that property investors made in 2023. With that. Let’s jump straight into the details.

1. Long Term Tenants

As we all know. Most Singaporeans own their properties be it an HDB flat or a private properties. Singapore has a highest property ownership in the world. However, do you know? There are families that are renting instead of buying their own property.

Yes. You are right to hear that. I know of some Singaporean families that are tenants and helping their landlords to pay for their monthly instalments. You may be asking. “Why aren’t they buying?” This is because they own overseas properties and buying an HDB flat means they have to sell their overseas residential properties.

I mean, if you have a valid reason to hold onto your overseas properties. Then by all means. But if you are staying in Singapore for the long term. I think it makes sense for you to own your properties instead of renting them.

You will never lose money owning a property in Singapore in the long term unless you buy something really crappy. This has been repeated throughout history and I believe the same for the foreseeable future.

2. Buying The Wrong Property

Most property investors desire to buy a property that has capital appreciation. This means some of them could be enticed to buy a property that does not fulfill their family needs. Yet, because of that potential upside. They sacrifice the needs of their family for profit instead.

Recently, I came across a family of 4 with young children. Instead of buying a more affordable HDB flat and living like a king. They decided to stretch their budget and go for a brand new 2-bedroom apartment instead. You know how small the bedrooms today are and the best part is there is only 1 bathroom.

Seriously, I really have to respect this family in squeezing themselves into a 700 sqf apartment. Not only that. They also have a helper staying with them. Can you imagine this? 3 adults and 2 children are staying together. The dining table is doubles up as a study table, and the balcony has been converted into both a store room and a laundry area.

I mean, stay in a condo until so difficult. Might as well buy a HDB flats that offer all the space you need. Unfortunately, the appeal of making money has outweighed the needs of the family.

This is one classical example. Others include buying a property for investment instead of buying for their own stay. Then there is also those that stretch all the way just to buy that popular condo. This means they have already crossed the red line. And the lists go on…

Anyway, this is their personal financial decision and you be surprised that many buy on impulse and without much logic. That is why there are always winners and losers in this property game.

3. Overpaying For a Property

In 2023, there are many attractive properties available for sale. Some of them are located within proximity to MRT stations, good schools, and so on. I also think they are a good product. However, the selling prices are pretty high for that location. For the same price point, one can get a freehold resale condo in prime district 9 or 10.

However, that can’t be said for the buyers who want to own a piece of the action. They came and see and placed a ballot for a unit. The response was overwhelming and sales were good. Many left disappointed. Some say they have money also cannot buy one.

However, I am a little skeptical if this is FOMO. I am also curious about its performance down the road. Will it outperform and make good profit for those investors? Or will history repeat itself and leave investors hanging dry? Maybe I could be wrong and the market chiong ahead.

In the years to come. I will do a review when they hit the resale market. So stay tuned to it.

4. Timing The Market

I know of some buyers who after selling their property. They would rather rent in the interim instead of buying. There is this popular saying. “Sell high and buy low”. However, this is something that is very subjective. What if prices never drop and go up again? There is the risk of pricing out of the market.

That is why I always advocate. Unless you can see and predict the market like a wizard. They sell high and rent in the short term and buy when property prices crash. However, if you are not an expert. Then it makes sense to sell and buy back quickly.

Unless you are holding back by HDB’s 15-month debarment period for private residential property owners. Then that is another story. Else. If this is your family home. It’s always good to buy back quickly.

Unless this is an investment property. Then you can sell and wait for the right time to enter again.

5. Fail To Sell

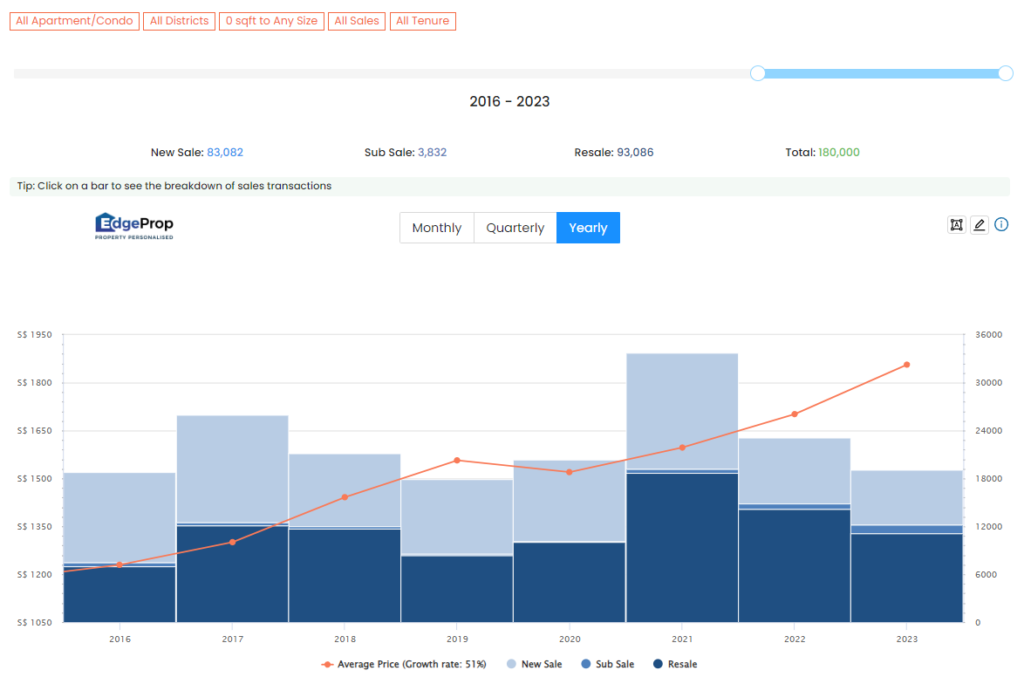

2023 is the year a lot of condos are collecting their keys. All these condos are launched before Covid 19. Most of them would have profited tremendously in the resale market today. There is also the pent-up demand to buy ready-to-move houses after the pandemic. That is why I believe 2022 to 2023 is a good time to cash out when there are still plenty of buyers around.

However, some investors see it likewise. They think there is an upside and more profit to make ahead. Well, this is their calling. But my personal take is to take profit and move on. Don’t be too greedy. If the market starts to turn.

Take note. These condos have many sellers at any point in time since they have a high proportion of investors. Will this lead to a spiral downward in prices during a bear market? This is the same principle with prices going higher with each transaction during a bull market.

On this aspect, do you agree with me on this theory? Please share your thoughts in the description below.

6. Buy Liability Instead of Asset

Property prices have been going up since Covid 19. This is the same for cars. I know some buyers would rather own a new car than a property. I mean this is their decision. I have no disputes about that. However, as you know the cost of owning a car is extremely high in Singapore. This means the downpayment is also high. This is coupled with higher car loans.

This means a property investor who wish to upgrade his property will be affected with a lower TDSR and this will affect his property loan. Moreover, the money for the downpayment for the property would have gone into buying the car. This means they wouldn’t have enough cash to pay for that property. Anyway, you get the idea. They chose to buy liability instead of asset.

That is why to date, I am still driving my 8 years old Mazda. I really hack care how my clients see me. If they want to engage my services. I will be very happy. But if they see my car and think cannot make it and choose not to appoint me. I am also very chill on this.

Anyway, I always believe that your car doesn’t determine your ability. Anyway, many of my well-to-do clients also drive very humble cars. Most importantly is must have money in the bank. Everything else is secondary.

7. Divorce

Divorce? Some of you here may ask me. What has divorce got to do with property? As you know. When a couple separate. They have to split their asset as per their divorce papers. In some situations, one party may need to give his or her ex-spouse part of his (or her) property or CPF funds. This means he will be worse off in a divorce. Not only that, he will also need to contribute to the maintenance of his children, if any.

As you know. A married couple usually has a stronger combined income altogether. This will allow them to own property of a higher value that has better capital appreciation. On the other hand, a sole income will limit one’s ability to own a better property.

I have dealt with many divorce cases in the past 14 years. The cases I have handled have increased significantly over the years. I can share that most of them are worse off after their divorce. The roller coaster ride in a divorce settlement would have drained them not only financially but also emotionally.

In fact, the worst off is not the divorced couple. The ones that are really hurt are their innocent young children. I have seen with my own eyes how their children are suffering in silence. It is not their fault. They are equally confused as to why they don’t have a complete family.

I know some say scandals are common in the workplace and they are not only limited to politicians. Humans have desires. Humans love beautiful things and humans also make mistakes. If you are having lobangs outside. Let’s spare a thought for your children.

With that. I hope you enjoy this blog and appreciate it if you could share them around if you think I make sense to you. That all. See you soon.