Can I Still Make Money From Property?

Most recently, someone I met asked me this question. “Can I still make money from property investment” Especially when the property prices index is on a record high, high interest rate environment and so many cooling measures. I decided to explore this topic in detail. I will explore HDB, condominiums, and landed segments.

HDB Flats

For HDB flats. I will classify them into both BTO and resale HDB flats. In line with HDB efforts to address the robust demand for housing, HDB committed to launch up to 23,000 flats in 2023. To date, HDB has launched a total of 24,447 flats which include BTO and Sale of Balance Flats.

In 2022 alone. HDB reports record deficit of S$5.38b. Delivers the largest number of flats in last 5 years. For 2023, I am very sure the deficit will continue to increase. Based on this HDB article, it mentioned that the amount collected from the sale of HDB flats in every financial year is less than the total development cost such as land and construction costs, and CPF housing grants for eligible home buyers.

If you still cannot catch the ball. Please watch my earlier video on, HDB to incur loss of up to $270m for Ang Mo Kio BTO project. In this article, I have painstakingly calculated HDB numbers. Based on my numbers, HDB is making a loss if factoring in land costs. Some will say. It is not fair to calculate land cost since it’s left to right pocket.

Okok. Never mind. What if HDB don’t build BTO flats and instead sells them to private developers? Guess how much can they make with a stroke of a pen? Well, they can easily sell them for $1,100psf and make a cool $1.2 billion from it. They don’t even need to entertain you.

But why are they building public flats? Well, Singaporean has already said they want affordable flats near familiar surroundings, especially for first time home buyers. They are concern they cannot start a family with high mortgage repayment.

This brings me back to my next question. Why is our government building so many public flats for the people. Well, its boil down to votes. If the people are happy. The politicians are happy too.

Side track here, I happen to see a very seasoned opposition politician in a petrol station pumping petrol next to his COE car. I am very happy that he owns 2 restaurants. I also hope that he continues to expand his F&B empire and forget about polities. Take good care of your family. Take good care of your own pockets. Anyway, I think the outcome for the next GE will be pretty much the same. There are no major housing issues. I am very sure my MND minister will be rotated to more challenging portfolio ahead.

So back to BTO flats. Can buy to make money?

Confirm 100% chop! Till date, I have never sold a MOP BTO flat that that loss money. In fact, most of them would have seen their valuation increase by 30% by the time they move in. But the time their flat MOP, they would have easily made 50% or more gain. HDB loss money selling flat to you. Can’t you seen the hint?

What about resale flat, well it really depends on the types, location, timing and many factors that affect its performance down the road. As I always mentioned. HDB flats are not for you to profit and make money like a private property. HDB flats are highly regulated. But then they make very nice home for family.

Condominiums

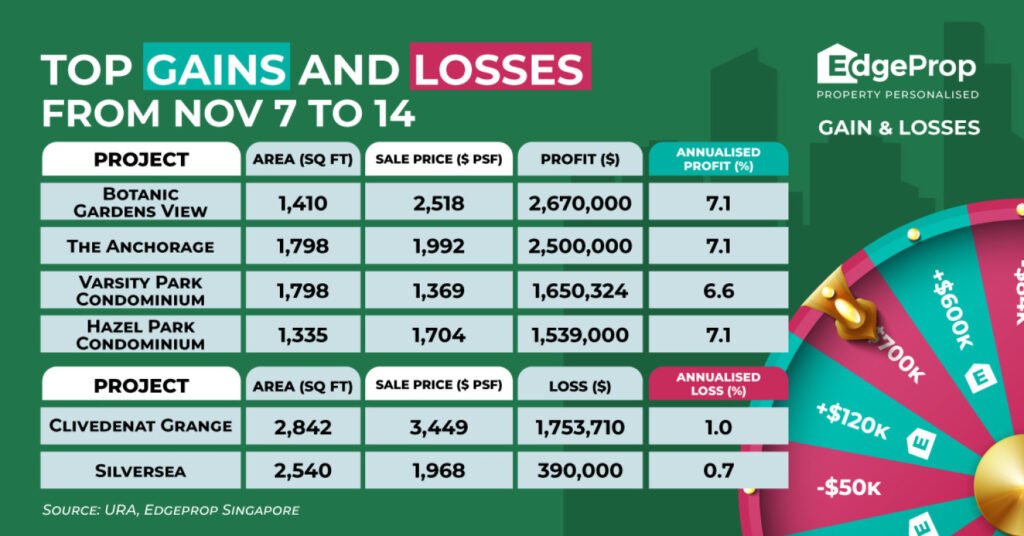

I tried very hard to dig out the data for both profitable and unprofitable transactions for the entire 2023. However, I realize it is extremely time-consuming as there is massive data for me to crunch them over. Moreover, it is not so straightforward to compare them with one another. Hence, I decide to make my life easier and decide to just use Edgeprop’s top gains and losses which they publish on their website on a weekly basis.

I will only compare October to December data. Let take a look at the first set of data. In this data, it mentions that Kovan Residences make $1.746million with an annaulised profit at 6.3%. Not bad seriously. Then you have The Sail at $1.42 million profit and Braddel View at $ 1.23 million. I assume both of these owners would have bought them many years ago.

Next, let’s zoom into the top losses. We have Hilltops which lost $650,000. Hilltops is a CCR luxury freehold condo in the Cairnhill area. Then we have One Shenton which is a 99 years condo in the CBD area. Lastly, we have Reflections At Keppel Bay which is another 99-year condo that is selling a seafront lifestyle.

Next, we have The Sovereign which is a source after freehold condo in District 15. Is it about 30 years old but stood the test of time. The 18 years old Shelford is another freehold condo along Bukit Timah Road. Then we have the 20 plus years Amaranda Gardens near NJC in Lorong Chuan.

For the unprofitable condo, we have Vermont on Cairnhill in District 10 to Lumiere in the CBD area.

Next, we have the freehold Morningside which is a 30 years old condo along River Valley. We have the 18 years old freehold Duet along Holland Road. Not forgetting the freehold Clementi Park.

Here, have you notice something? Most of the profitable condos are on freehold tenue, old projects, have practical living space and located all around Singapore. Interesting right? Some may argue they are bought many many years ago that is why they make a lot of profit.

Ok that is fair. But most importantly, it has also proven that buying the right property and with a long-time horizon will ensure that you profited handsomely in this property game.

On the other hand, most of the losses are located in the CDB, Keppel to Sentosa locality. With a handful of losses such as the 99 years Seahill in the West Coast to Silversea in Marina Parade.

This set me thinking. Why are they losing money? Well, I think I have covered them in my earlier videos. They boil down to a lack of demand, mainly targeted at foreigners, high entry prices and quantum that is beyond the reach of most Singaporeans. If Singaporeans have that kind of money. They might as well buy landed properties instead. This is a no-brainer. Why bother to pay airspace and high maintenance fees? This brings me back to my last segment.

Landed Properties

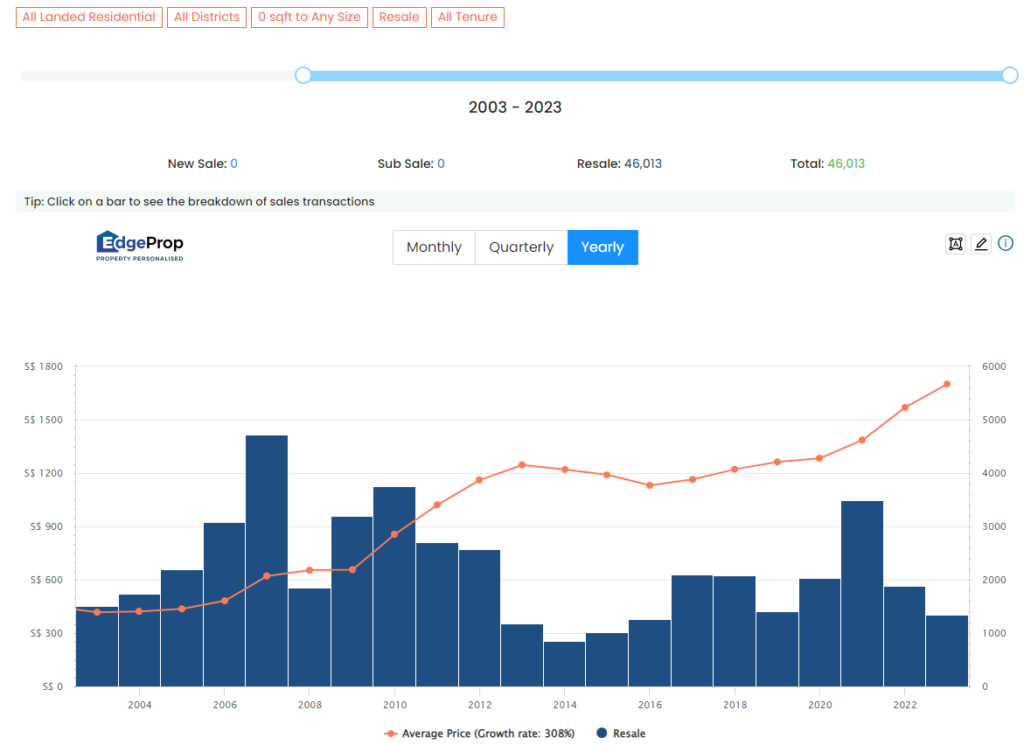

I always believe numbers don’t lie. This is the 20 years resale data for all landed properties in Singapore since 2003. You can see clearly that prices have been on an upward trend. Till date, landed prices has appreciate 308%. This mean if you own a $1 million landed property 20 years ago. Today, it will be worth a cool $3 million. What about Good Class Bungalow?

Prices has shoot up the roof. Prices has appreciated 458% in the last 20 years. Your $5 million GCB will be worth $23 million today.

Here, the biggest question is? Will landed prices continue to inch up?

In my personal opinion. In the long term, is a definite yes with scarcity supply at play. With mass market condo already hitting $2,000psf. This mean landed prices which is usually calculated based on its land area instead of its build up area. It is still undervalued. That is why I am still bullish on this segment. In the short term, if market condition turn, it will affect its performances. But in the long term, it will be a clear winner.

Conclusion

Here, what can we conclude? Firstly, HDB BTO flats sure make money. Whether they are standard, plus or prime flat. All will Huat upon MOP. As for resale HDB flats. Just buy and stay and enjoy the space. If you keep them long term, I doubt you will lose money.

What about private condos. We have already seen this trend of CCR condos losing money plus some condo in the RCR area also start losing money. I wouldn’t be surprise to see more OCR and RCR condos losing money when they hit the resale market. This is especially so for condo that don’t have that own stay appeal. This mean they are mainly built for investment. The high entry prices in a peakish market may also be at their disadvantage. However, this is with the exception of EC which I think they are still worth exploring.

As for the landed segment. If you have the funds and are eligible to buy. Just buy. I doubt landed prices will crash even in a recession. The most it stays flat.

That all, I hope you enjoy this video. If you have any plans to cash out. I will be more than happy to assist you.

As we inch towards the end of the year. I have last counted. This is my 85th videos I have did for the entire 2023. I hope you have seen how I have improved my videos over time. The initial videos really cannot make it. It is definitely not easy doing videos from scripting, shooting to editing. Nothing is easy.