The Arcady At Boon Keng – Can buy or bye-bye?

In today’s discussion, I am going to talk about an upcoming new condominium in District 12. This condo is known as The Arcady At Boon Keng.

This is within the Rest of the Central Region or RCR. It is just outside the CBD. This condo is on prized freehold status. Is it worth buying? Without further ado. Let’s go straight into the SWOT analysis, but firstly let’s study the site details first.

The Arcady At Boon Keng - Site Details

The Arcady At Boon Keng is located along Saint Barnabas Lane, off Serangoon Road. It is 7 to 8 minutes walk to Boon Keng MRT station where you can travel to the city in just a few MRT stops. It is also near the popular Bendemeer Market and hawker centre which I frequently go to.

It is developed by KSH Ultra Unity which comprises a joint venture of KSH Holding, SLB Development, and Ho Lee Group. They have acquired Euro-Asia Apartments for $222.18 million in 2022. This freehold enbloc site sits on a 56,476sqf land that has a plot ratio of 2.8 under the URA Master Plan. The purchase price translates to a land rate of $1,313 psf per plot ratio.

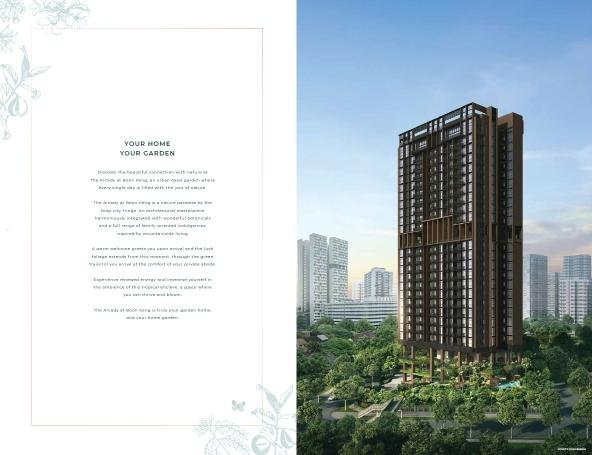

This single tower block is 24 stories high with 172 units. There is a mixture of 1 to 4 bedrooms and penthouses. There are facilities on the ground level, 14-storey sky terraces as well as rooftop areas. Those units on the upper floor can have an unblocked view of the surrounding area. Those fronting the North can have pocket view of the Kallang River. Those facing Southward can see Marina Bay.

These are some artist impressions of the project. Not too bad I feel even the site area is not very big. There are facilities everywhere from swimming pools, BBQ pits to a gym that is located above ground.

Here, let’s briefly go into the floor plans. There is only 1 stack for the 1 bedroom plus study. It measures 49sqm. In typical fashion. The living and bedroom face outward with an open-concept kitchen and a study next to the foyer. Not bad. At least they have done up a study area and this is suitable for renting out to tenants on a shoestring budget.

The 2 bedrooms plus study start from 71sqm onwards. They are mirror images. The layout is almost identical to the 1 bedroom except that there is another common bedroom and a common bathroom.

The 3 bedrooms premium start from 101sqm. It comes with an enclosed kitchen, a foyer area plus a household shelter. The bigger 3 bedrooms have a wider living and dining area. Else the rest of the layout is almost the same.

As for the 4 bedrooms. They measure a comfortable 131sqm. It comes with 4 bedrooms, 2 bathrooms and a study.

There are 2 penthouses that measure 240sqm. Seriously this is dam huge. I think you can really live like a king on the topmost floor.

So much about the floor plans. Let’s dive straight into the SWOT analysis.

Strength

In terms of location. This is a city fringe location. Near city. Near Orchard Road. If you like a happening lifestyle plus access to good food. Then this is the place.

Secondly, it is on freehold tenure. This is going to stand apart from the rest of the 99-year condos around the vicinity. This is especially so if your neighbours are mostly on freehold tenure.

Thirdly, this is a new condo with new facilities. Everything is new. Some buyers prefer to stay in a new development because there will be fewer maintenance issues. Moreover, I find that the architect has put in effort to create an iconic and distinctive condo along Serangoon Road. This condo could become the next landmark in this area.

Fourthly, it is near many reputable schools within the 2km range. This means families who are keen to live near schools will consider this in future.

Do you know this place has a certain charm on its own? It is surrounded by HDB flats, condos, and landed properties. The nearby Sri Lanka temple and churches also give some character to this place which is commonly known as Saint Michael. If you love to exercise like me. You can exercise along the park connectors along the river. You can either go to Whampoa Market or Sports Hub via the PCN.

Lastly, the joint venture partners have previously undertaken some projects including Riverfront Residences, High Park Residences, Park Colonial to Affinity@Serangoon. These are relatively bigger projects. Therefore, I am sure they can deliver this project up to buyers’ expectations.

Weakness

Let’s look at the numbers. The breakeven cost is $2,246psf. Let’s assume a 15% profit margin for the developers. The developers need to sell around $2,600psf. Is this doable? Maybe it is still possible as 99 years OCR projects are already trending above $2,000psf.

On another note. I have studied the past transactions for this newly completed condo that TOP last year. This condo is known as Jui Residences. Seriously, got so many names. Can call Kallang River Residences or Moonstone Michael Jackson condo. Why call Jui Residences? You go and ask old people to pronounce it. They will pronounce it as either Zui or Chui. Hiaz…

Anyway, let’s look at their profitable transaction. Not bad leh. Got 5 transactions that are profitable and zero unprofitable transactions. Profit ranges from $40,000 to $132,000. In terms of annualized return. They range from 1.1% to 4%. Hum….

I can only say mediocre return so far. Can cover some expenses and maybe make $50,000 after holding it for 5 years. Maybe the name already said it all.

Another weakness of The Arcady are those units facing the busy Serangoon Road. This means they will bear the brunt of the road noise even for high-floor units as noise can travel upwards. Those lower floor units must also clear the HDB flats to have some decent views. Else if you see your HDB neighbour. You also sian.

Opportunities

There are not many new freehold condos in this location other than Jui Residences. This means The Arcady will be sourced after by buyers who are keen to buy a newer freehold condo near the city.

In addition, there are a lot of HDB BTO owners staying in nearby Towner Road to the Bidadari estate. I am very sure. Most of these flats will be selling for more than a million dollars each once they reach MOP. This means there will be a steady stream of buyers who are looking at upgrading to nearby condos.

Threat

As usual. Market risk. Are you entering the peak of the property market? Nobody has an answer to it. That is why whenever you are buying property. Always buy with a mid to long-term horizon.

Another threat is the upcoming new homes coming into the market. There will be another Jalan Tembusu site which is developed by Sim Lian in D15. It will likely be launched in the second half of this year. There are also a few smaller sites. They are mainly freehold and located in Pasir Panjang to Fort Road.

There is also the threat of existing homes that are unsold from the CCR to the RCR area. Developers may cut prices to move units if sales remain muted. This will indirectly lead buyers and investors away.

However, I think the real threat comes from the high-interest rate environment plus a more cautious economic outlook ahead. Buyers are fearful to commit to a big-ticket item unless that condo has some unique selling points.

Can buy or Bye-Bye?

In summary. Can buy or bye-bye? My thought is. If you are looking into a freehold condo plus a preference to stay near the city area and looking for a new condo to invest in. And also a condo that is not too massive. Then you should consider The Arcady provided you have a mid to long-term horizon. Here, if you have plans to consider this project. My company is the appointed marketing agent. Please register your interest with me.

Before I end the video. I would like to share with you regarding scams affecting the property industry. There is a resurgence of scams that involve property agents. Here, these fake property agents will make you make payments to secure a viewing for a rental property.

So far, between July and November 2023, at least 287 victims have fallen prey with total losses amounting to at least $1.8 million. This means each of them loses $6,000 each. Property agents are not permitted to demand payments to view the premises. Rental deposits must be paid to the landlord’s bank accounts, not the “personal assistant” bank account or PayNow number. Always be careful. Don’t be shy to ask for proof of ownership and owner’s banking details.

In addition. I wouldn’t be surprised if one day they will fake a property to sell and ask you to give that 1% option money without viewing. These are your hard-earned money. The last thing is to lose them. Let’s fight scams together.