Property Market in 2024 – What Can We Expect?

In this blog post for the year. I will focus on what can we expect to see in the property market in 2024. Are we going to see another bullish market? Are our HDB flats going to retain their value, and what about the non-residential market in general?

Again, I will justify my assessment with my feel on the ground and with supported data. Here, let’s go!

HDB Resale Prices

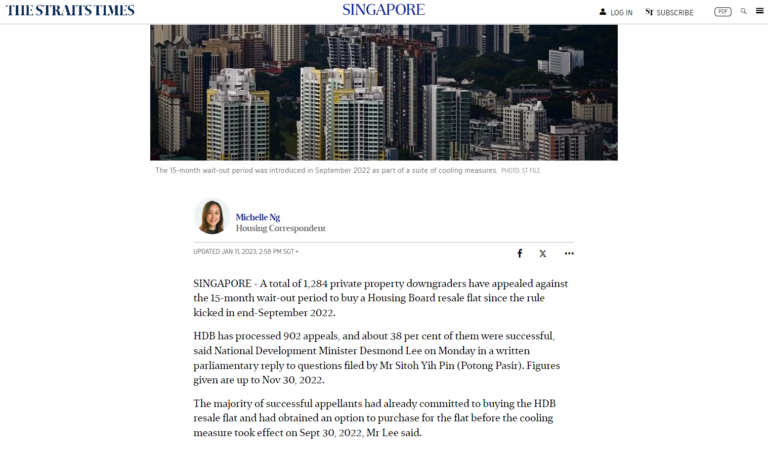

For a start, I would like to focus on the HDB market. Can everyone still remember what happened on the 30th of September 2022? I assume most of you would have forgotten about it. To everyone’s surprise, HDB announced a 15-month wait-out period for private property owners who wish to purchase a HDB resale flat. This means the 15-month wait-out period would have ended on the 1st of January.

This means based on this Straits Times article. I quote. “A total of 1,284 private property downgraders have appealed against the 15-month wait-out period to buy a Housing Board resale flat since the rule kicked in, in September 2022. HDB has processed 902 appeals, and about 38 percent of them were successful.” This means 62% were not successful or close to 800 private property owners have finally sensed a huge sigh of relief. I can finally buy a house already.

However, when they start to search online and look for HDB resale flats. They will be disappointed to find that there aren’t many good listings around. Why is that so?

Firstly, December is traditionally a holiday period and not many will be selling their properties. Secondly, Chinese New Year is around the corner. So don’t expect to see Chinese sellers putting up their property for sale. I transacted a few HDB listings late last year and I am equally surprised by the fast turnover.

Coming back to data. Will HDB prices continue to increase or decrease?

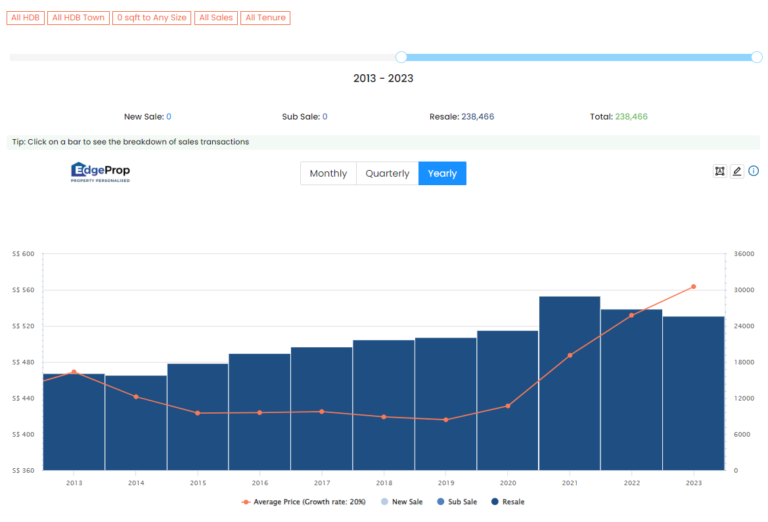

I have selected all HDB towns and all flat types to be consistent in my analysis.

Let’s take reference from 2020 which is the Covid year. The average psf was only $431psf. In 2021, prices start to creep upwards to $488psf. Then in 2022, it continues to go higher to $532psf which is a 9% jump from the year before. Then in 2023, it continues to rise to $564psf. This is another 6% increase if I used Edgeprop data as a comparison. Take note, this is not HDB data. Please refer to HDB official numbers.

Based on the above data HDB prices have increased close to 31% since 2020. With more BTO MOP flats that are put up in the resale market. I believe these numbers will continue to climb higher. So back to the question. Is HDB’s 15-month wait-out period effective?

That is why I always feel this is a short-term solution to a bigger issue. The number of private owners has never been a lot in the first place. Maybe 10% to max 20%. Based on this ST article, Minster Lee has mentioned “In the past three years, one in 10 HDB resale flat buyers has been a private property owner who sold his existing home to buy an HDB resale flat”.

So, who is buying resale flats? Again, some will say it’s the foreigners that are buying. Well, foreigners cannot buy HDB resale flats. Then you will have people that complain it’s the PR. I can share with you that PR only makes up a small portion. I don’t have that figure but it’s not significant. The biggest groups of buyers are still Singaporean from singles to HDB upgraders that are priced out of the private property market. The last group is very significant, especially with high private prices today. That is why they turn their attention to million-dollar bigger HDB flats.

Sadly, this is a segment that is not well covered in the mainstream media. Maybe an election is coming. Cannot anyhow write. Later no bonus how?

Rental Market

I can still recall from the 2nd half of 2022. There was a huge spike in rentals across all residential properties. This is mainly due to the influx of foreigners taking up employment plus foreign students studying in Singapore. This is exacerbated by the surge in demand from private property owners who are left hanging dry when they cannot buy a HDB resale flat.

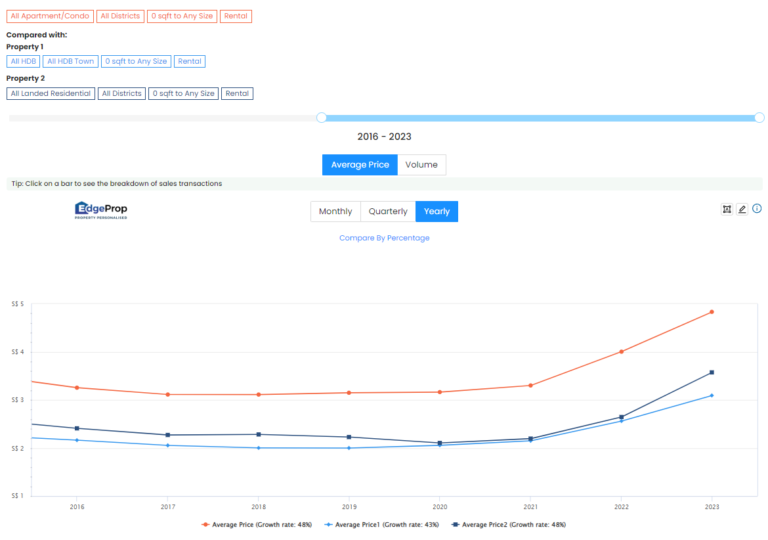

From this chart, you can see the rental rates for the 3 main segments. The orange curve is for private condominiums. The light blue is HDB and the dark blue is for landed properties. We can observe that rental rates have surged since 2021. If we compare the current rates to 2021. The rental has easily increased by close to 50%.

However, based on my understanding on the ground. Rental for HDB flats is still going strong. Recently, I have leased out a few HDB flats within weeks. Interestingly, some of the tenants are previously staying in a condo. I called them the private condo tenants down-graders. They are moving towards more affordable HDB flats for affordability and practical reasons.

On the other hand, private condo rental has been very slow. Why is this so? Well, I have 2 reasons. Firstly, there have been a lot of TOP condos since last year from Normanton Park to Tampines Treasure to others. Tenants are spoiled for choice. That is why some of them move to newer condos that have better facilities. The rental is also more attractive because we have desperate landlord trying to lease out their apartment for months.

Secondly, and also coincidently the rise in rental rates for private condos in recent years could be due to the proliferation of Co-Living operators. What is Co-Living? Well, it means a company will rent your entire apartment, partition the space if available, furnish it up, and rent it to individual tenants separately.

In short, the rental yield is traditionally higher than renting to a single tenant. This means these companies are willing to pay higher rent. This is the same theory behind the all-high COE prices where private hire car operators are bidding aggressively for COE because they want the COE to do business. This indirectly pushes up prices.

In my opinion, the high rental we seen in the private market is not sustainable. It is getting tougher to find tenants. That is why rental for private condos will face headwind this year.

Private Condo Prices

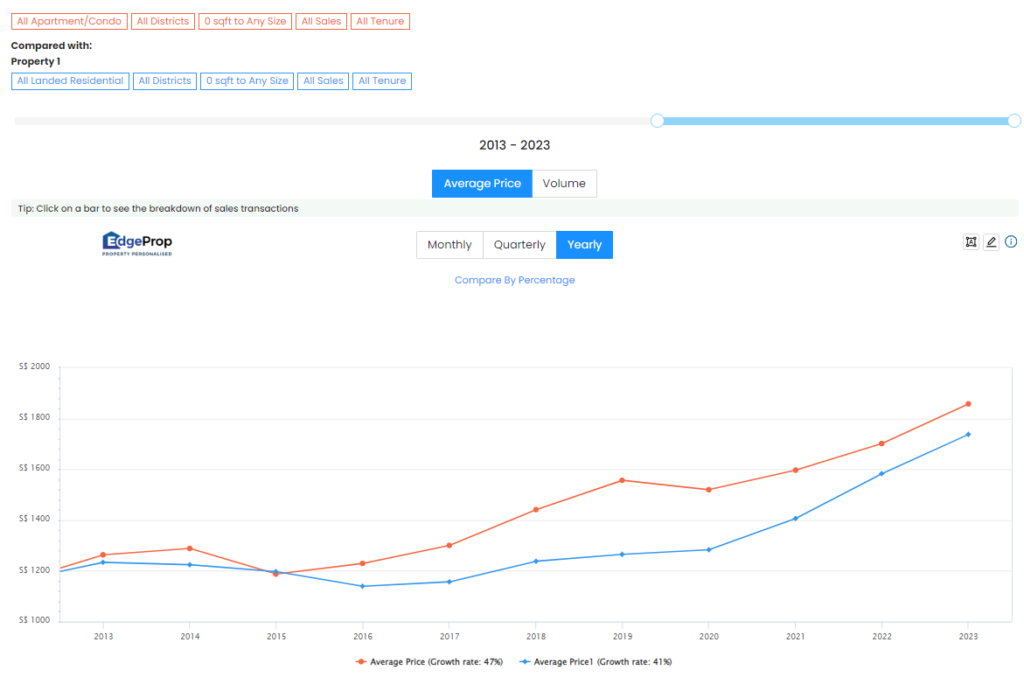

I have already mentioned many times in my video that this year we will see more new launches selling above $2,000psf upwards. This has become a new norm. This will further push up the property prices index. However, based on the past recent launches except for a handful that received overwhelming response due to its site attributes. Their take-up rate is not as good as before. Units are still moving but they are slower.

The government is also keeping a very close watch on this segment. Based on the government land sales program for 1H 2024. The Confirmed List supply of private housing in the GLS program has been further increased from 5,160 units in 2H2023 to 5,450 units in 1H2024. This is a 5.6% marginal increase.

The government has already warned the market. Don’t anyhow bid. If you bid high. Don’t expect to sell high. The old saying goes. “If you build, they will come.” But what if they don’t come?

Will there be further cooling measures? I doubt so. They just hiked the ABSD for foreigners to 60% in April last year. I think the authority will monitor the market further before coming out with any new measures. However, the signal is very clear here. The market has reached a peak at its highest level. Can it continue to inch upwards?

I feel the private market will stay flat or marginally increase due to the high-interest rate environment. Unless the interest rate goes back to the pre-pandemic level. Then buying an investment property will make more financial sense.

What is your view? Feel free to share them in the description below.

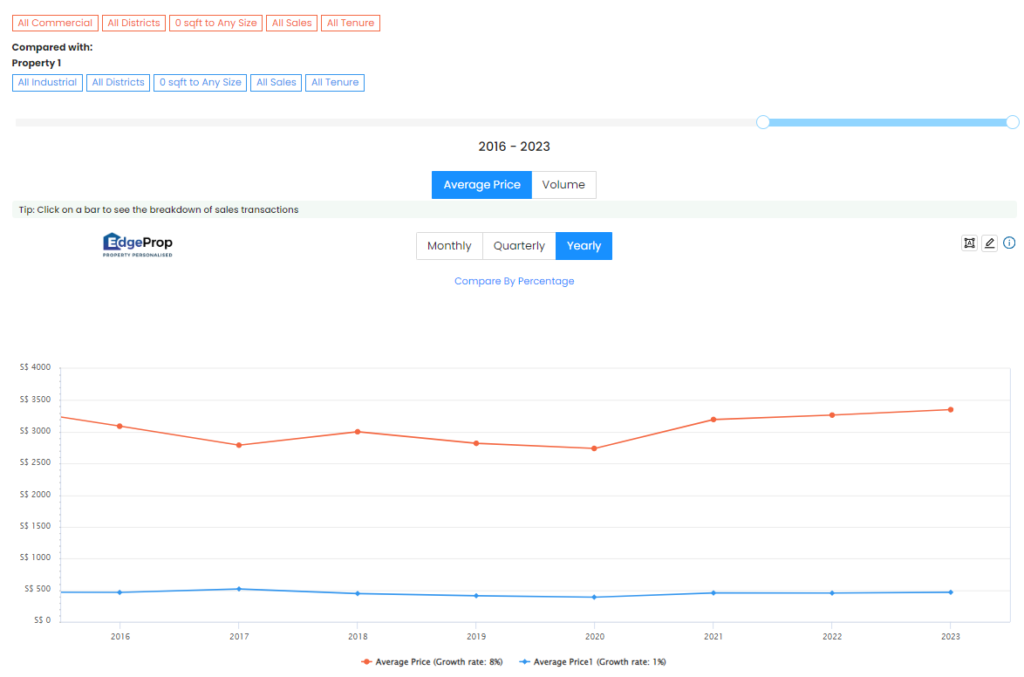

Commercial and Industrial Spaces

What about non-residential segments? Ok lah. I will just cover just a little as I know most of you are not excited about this segment. This is the price chart over the years. Sorry folks. The data only allows me to zoom in from 2016. I cannot zoom in further. Nevertheless, we can see the price chart for commercials has seen some variation over the years. It is slowly increasing mainly due to the attractiveness of shophouses. This is a segment that family offices, investment funds, and high-net-worth individuals are still looking into mainly because they don’t have ABSD. I will do a video on shophouses when I get the time.

For industrial properties. Prices have mainly remained relatively flat after JTC stopped selling industrial land on a 60-year leases. The 30-year leases is mainly for end users and this has put a dampener on HDB and private owners who are keen to be part of the action.

The only silver lining for investors is Fragrance Group boss bags two industrial buildings for $101 million. They will likely redevelop them into strata-titled freehold space and sell it. If you are keen to diversify your portfolio. I think you can consider it. I expect demand to be robust since there are not many freehold factories for sales in recent years.

In this segment. I am not an expert. However, I foresee prices to remain flat. If you have other opinions on this. I welcome you to share them with me.

Conclusion

Overall, a property crash remains unlikely unless there is an external shock. Price growth will remain muted in the near term. However, any runaway prices for HDB will be very worrying for the authority as 2024 is likely an election year. The authority will be extremely careful about any new measures that will affect the market, and obviously every vote counts.