Lease Buyback Scheme – Is LBS Suitable For You?

I am going to talk about the Lease Buyback Scheme or LBS for short. This is after one of you has asked me to do a video on this which I think is very interesting for seniors who are tuning in to this channel.

LBS is an initiative by HDB to monetise your flat to receive a stream of income for your retirement years, while continuing to live in it. You can sell part of your flat’s lease to HDB and choose to retain the length of lease based on the age of the youngest owner. The proceeds from selling part of your flat’s lease will be used to top up your CPF Retirement Account (RA). You can then use your CPF RA savings to join CPF LIFE, which will provide you with a monthly income for life.

Lease Buyback Eligibility Condition

Here, what are the eligibility conditions? Firstly, all owners need to be above 65 years old. This scheme is only open to Singapore citizens. Your gross income must be $14,000 or less. LBS is open to all HDB flat types except studio flats on short leases, HUDC, or EC. You must not own any private property. All owners must fulfill the 5-year MOP and lastly, your flat must have a balance lease of 20 years to sell back to HDB.

Next, let’s go into the details on how LBS works.

How Lease Buyback Scheme Works

If you are eligible for LBS, you will be able to sell the tail-end lease of your flat and receive a LBS bonus.

The LBS bonus is a one-off cash given to you based on your flat type. If you own a 3-room or smaller flat. You will receive $30,000. If you stay in a 4-room flat, you will receive $15,000. If you stay in a 5-room or bigger flat, you will receive $7,500.

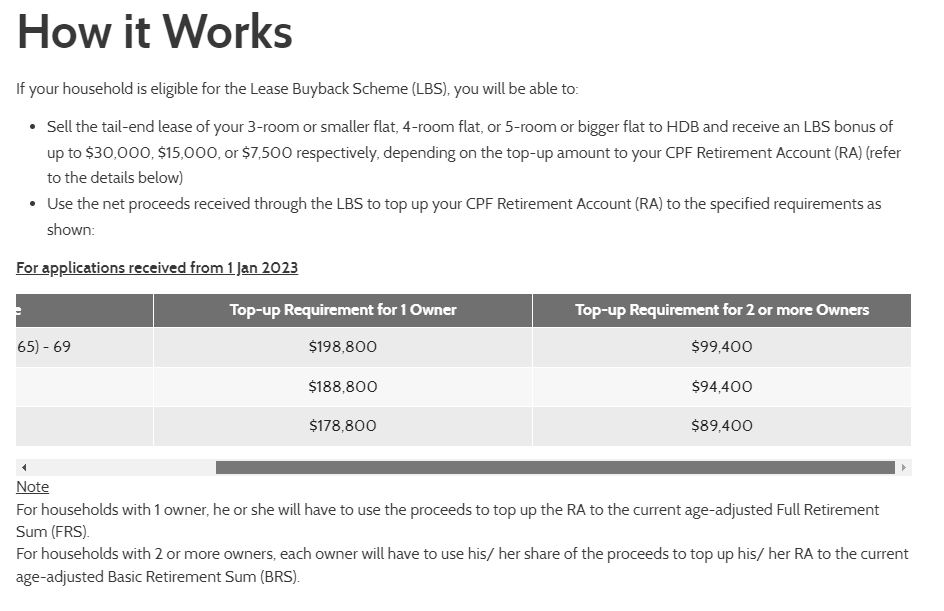

There is some condition to the LBS bonus. Firstly, you must use the net proceeds received through the LBS to top up to your CPF Retirement Account (RA) based on your respective Full Retirement Sum or FRS. What does this mean?

Assuming you are in the 65 to 69 years age group. Your FRS is $198,800 as of 2023. This means that after selling your flat to HDB. You will need to top up your RA back to the FRS. This is applicable for households with 1 owner.

For households with 2 or more owners, each owner will have to use his (her) share of the proceeds to top up his (her) RA to the Basic Retirement Sum or BRS. The BRS is half of the FRS which works out to $99,400.

After you have topped up the RA to the specified requirements as shown, you may retain the proceeds in cash, up to a maximum of $100,000 per household. If there are any remaining proceeds, owners will have to use their share of the remaining proceeds to further top up their respective RAs to the current FRS, before they can retain any balance in cash as well.

Your full RA savings will be used to buy a CPF LIFE plan if you have at least $60,000 in your RA after the top-up. Very confusing right? Nevermind. Let me show you an example so that it will be easier to understand.

Lease Buyback Scheme Example

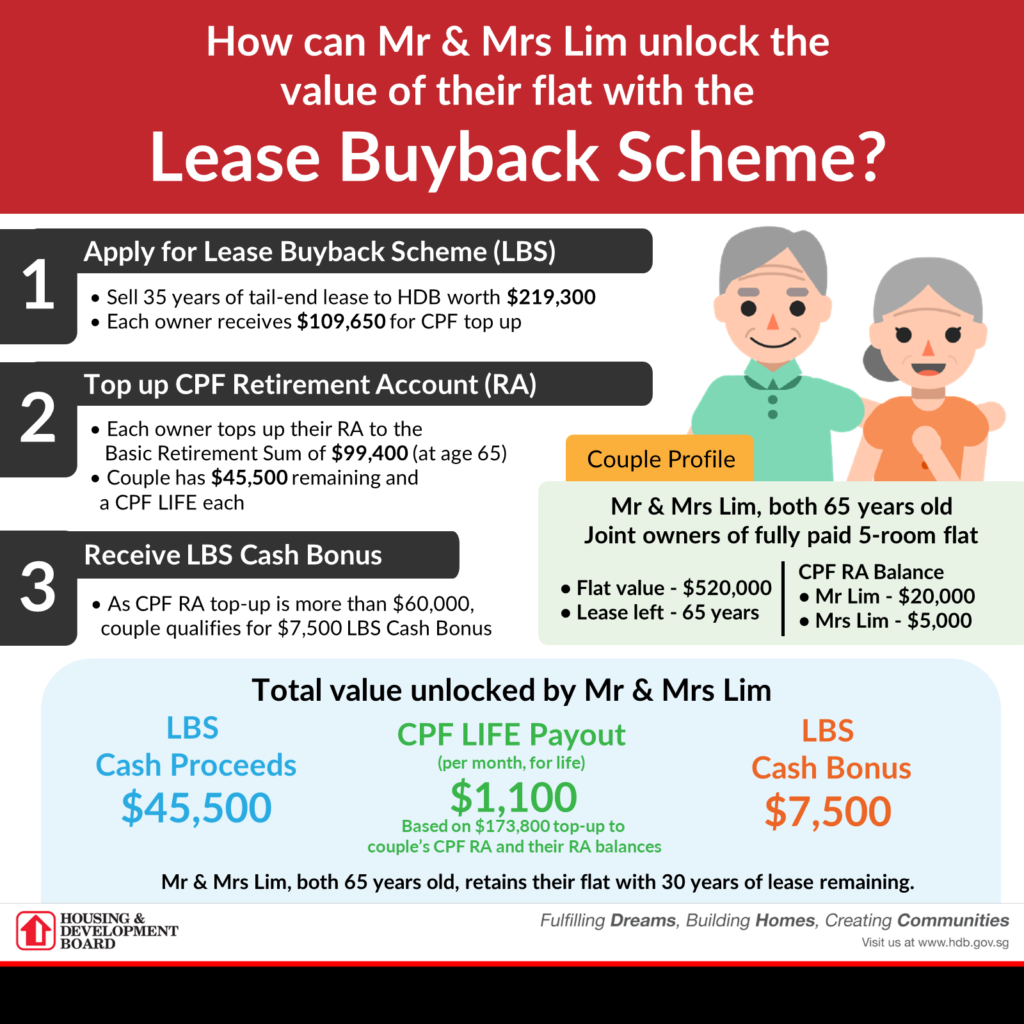

In this example, a married couple that is aged 65 years old. They own a 5-room HDB flat held under joint tenancy. No outstanding loan and the flat left with a balance lease of 65 years. Current market value is $520,000. They chose to keep a 30-year lease. This means they will be 95 years old when the 30-year lease is up. This also means they can sell the tail end 35 years back to HDB at $219,300.

Let’s assume the husband has $20,000 in this RA balance as for the wife, she has $5,000 in her RA. In this case, the BRS is $99,400. Therefore, the shortfall for the husband is $99,400 less $20,000 which is equal to $79,400. Whereas, the wife shortfall is $99,400 less $5,000 which is equal to $94,400.

This means by selling the tail-end lease to HDB, the couple gets $219,300. After topping up the husband’s shortfall of $79,400 and the wife’s shortfall of $94,400. The couple will receive LBS cash proceeds of $45,500 in cash.

Let me sum it up for you. The couple will receive $45,500 in LBS cash proceeds. The other funds that will go into their CPF Retirement Account will be used to buy CPF Life, which will pay them $1,100 per month for life for each of them. In addition, the LBS cash bonus is $7,500.

In summary, they will take back $53,000 cash on hand or 10% of what their flat is worth in the first place, which is $530,000. Hiaz.钱真的是不够用啊

Any question? Is this a good deal?

My only concern is the payout of $219,300 based on the tail end of 35 years. This is a critical part of the argument. If this amount is not attractive enough. This means the cash you receive on hand will be even lower.

Next, let’s zoom into the top losses. We have Hilltops which lost $650,000. Hilltops is a CCR luxury freehold condo in the Cairnhill area. Then we have One Shenton which is a 99 years condo in the CBD area. Lastly, we have Reflections At Keppel Bay which is another 99-year condo that is selling a seafront lifestyle.

Is Lease Buyback Scheme Suitable For You?

Well, there are a lot of arguments on this. Firstly, the benefit of LBS is to allow you to continue to stay in your current flat until you bye-bye. Secondly, it allows you to monetise your flat and receive some cash, and contribute back to your CPF RA to receive your CPF Life until your last day. As for the LBS bonus, it is only a sweetener.

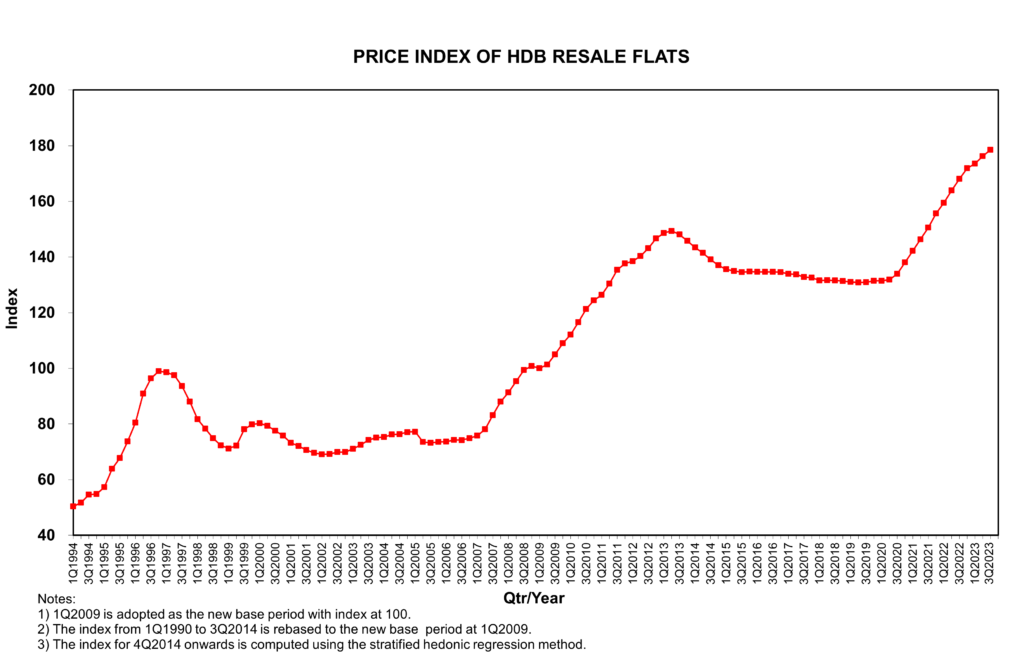

Here, what about the drawback? When you sell your flat to HDB. This means you don’t hold on to any more property. What if prices continue to gallop forward in the next few decades? Which there is a high probability. Will you be short-changing yourself by selling now to HDB?

Back to the earlier example. When you sell the tail end – 35 years back to HDB at $219,300.

In my personal opinion, it doesn’t justify all the trouble to top up your RA and take back so little cash back.

Alterative Proposal to Lease Buyback Scheme

I mean. If I can sell my 5 room at $520,000. This also means I can easily buy a 4 room at $450,000 or a 3 room at $380,000 in the same housing estate. Assuming I move to a 3-room resale flat. The difference between a 5 room and 3 room say is $140,000. Minus away agent fee, stamp duty, and renovation. You can still collect back $100,000 in cash. And the best part, you still own your flat which will still appreciate in value over time. If money is not enough, you can rent out one bedroom for rental income.

When your funds are dry up. You can still sell your 3 rooms assuming it remain flat at $380,000 and buy a studio flat for $150,000. You will stick pocket a cool $230,000 in your twilight years. HDB has given you a lot of options. I think buying a studio flat makes more economy sense.

Lastly, if you go for LBS. This means you will not be leaving any legacy for your children. That is why I feel LBS is suitable for those who stay in a 3 or smaller flat and have no more source of income, they also do not need to leave any legacy behind. Plus, they have reached a point of time to stay put in their current flat till the last day of their life. This is a personal calling. There is no right or wrong as long it suits your personal needs.

However, if you are staying in a 5-room or even a 4-room flat. There is the option to go for a studio flat. I think this is a very good initiative by HDB to allow our seniors to age in place. Moreover, if you have visited any HDB studio flat and its surroundings. I think HDB did a fantastic job. There are seating areas everywhere, activities for seniors, grab bar for assistance, emergency call points, and many others. The best part, you are eligible for many government subsidies yet staying in a familiar environment.

Here, back to aging. I have come across many elderly living alone. You be surprised they have children but they hardly visit them. Their children may be too busy with work or with their own family, while some stay very far away. Some are not in good relationships and so on. If you have such children who are so busy with their lives and ignore your existence. Maybe it is time to do LBS or even go for a studio flat. After all, I assume most of them need anything from you.

At the same time, if you happen to have an elderly relative staying alone. I think it makes sense to visit them once in a while. Help them with their day-to-day affair such as the use of the Internet and dealing with government departments.

Do you know why? Many years ago, I was selling a condo owned by an old man who live alone that has passed on. The nephew who was handling the sale shared with me that his father has instructed him to take good care of his uncle since he never married. For many years. He will visit him and check on his well-being. True enough, when his uncle passes on. His estate is worth $2 million dollars and the nephew was the sole beneficiary. I think his father has great foresight.

Here, what can we learn from all these? Well, it helps to be nice to others.

That why. if you have benefited from my video. Appreciate if you could help to share my videos around so that more people will benefit. If you have any lobangs. Don’t forget about me too. That all. See you around soon.