Property Lobang in the Core Central Region

In today’s discussion, I will talk about the opportunity that I recently uncovered and why you should consider it if you can afford to. You are really in for a treat. Never ever before have I shared so openly where are the property lobangs. Here, let’s go!

Core Central Region

Some of you here have privately asked me if I don’t like the Core Central Region or CCR. After some of my videos have highlighted their weak performances in recent years. Here, please don’t get me wrong. I am never against any specific property segment. I love property very much. How can I hate them? I am only interested in their performances but that doesn’t mean I don’t like them.

As we all know. Most new homes in the Outside Core Region or OCR are already trending above $2,000psf this year. Come 2024, new home prices are going to increase from $2,000psf up to $2,600psf whether you like it or not. They are going to see yet another record high.

This only set me thinking. With rising new launch prices in the OCR. This means their prices are almost comparable to resale condos in the CCR area. Moreover, most of the resale condos there are of freehold tenure, closer to Orchard Road and CBD. Which is the heart of Singapore. Anyway, do you know where is the heart of Singapore. Well in my opinion. It is located at The Fullerton Hotel which used to be the General Post Office during the colonial days.

Here, how can upcoming new condos that are located away from the city be sold at almost the same prices as Orchard Road? Something is not very right here. It is either new homes are selling at a premium or CCR resale condos are massively underpriced? What is your take on this? Don’t mind please share them in the comments section below.

Hold on. Talk is always cheap. I don’t suka suka anyhow talk. Let me dive into the data to make sense of this theory.

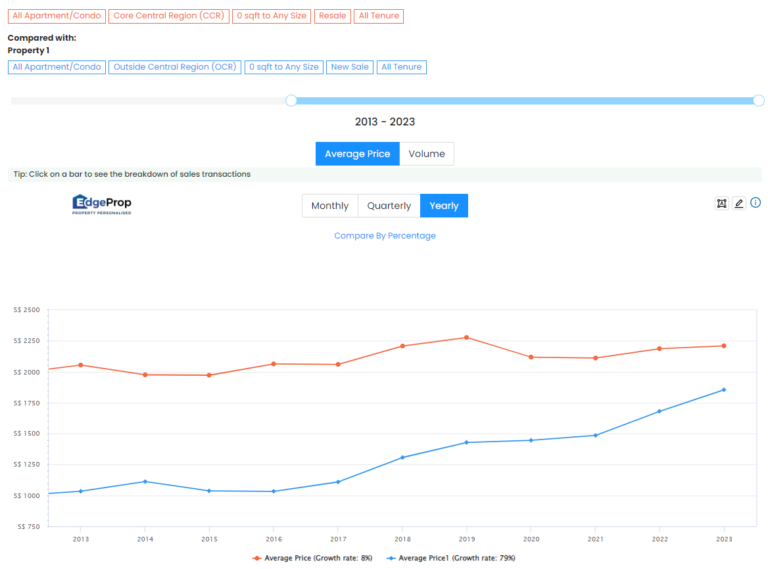

As usual, I have extracted Edgeprop data. The CCR resale condos is in orange and the OCR new launch condo is in blue. I have used all tenure to be fair in my comparison. From the chart, we can observe that back a decade ago. Resale condos in the CCR are selling for $2,054psf verse $1,034psf for new condos in the OCR. This means resale condos in the CCR are selling a 99% premium against new condos.

Over the years, we can see that CCR prices increase a little until they start to drop during Covid-19, before they slowly increase again. On the other hand, the OCR prices have been on an uphill climb over the past years until they narrow the CCR prices in 2021. This is no doubt the very same year when the property market started to recover from the pandemic. Subsequently, the OCR average prices stand at $1,855psf whereas CCR is $2,210psf. This means resale condos in the CCR are selling at a 19% premium against their OCR counterpart.

Here, if we compare them over the past 10 years. CCR prices have appreciated only 8% whereas OCR prices have increased 79% to date. This is an extra 71% bull run! Can this bull run continue? Or is it time for undervalued CCR to play catch up especially so after you have watched this video and take massive action?

This is a very interesting observation. This reminds me of something. It is like shopping mall operators bringing Orchard Road to the heartland. One good example is this newly opened mall in Holland Village which is called One Holland Village by Far East Organization and Sino Group. I think Far East gets it right now in designing and operating malls.

Here, there are a wide variety of restaurants and offerings for those staying nearby. Plus, the cost of food is almost the same as those in Orchard Road. This brings me back to a question.

Are developers bringing Orchard Road to the heartland? Here, is staying in the heartland the same as staying in town? Or has buyers’ appetite changed? Especially so with “Orchard Road” malls located nearby? Does location still matter to them?

This is something I am very puzzled. I just wonder if buyers have miss out on good lobangs in the CCR area. With that let’s head over to some resale condos which I think are worth considering.

The Vermont on Cairnhill

You are right. Some of the properties that I am going to recommend are located near Orchard Road. How can you be wrong next to Singapore’s most popular shopping belt? This place is mainly suitable for those who cherish the proximity to the city and appreciate the freehold title they are sitting on.

When I was doing my earlier video on the “Can I Still Make Money From Property” I came upon this condo known as The Vermont on Cairnhill. The earlier owner has lost $200,000 for this 2-bedroom apartment that measures 915sqf. The sale price was only $2,514psf. This set me thinking. This is OCR new condos prices!

As I look further into the data, the first owner bought directly from the developer at $2,732psf in 2012. As I scroll through the rest of the unprofitable transaction. They are mostly purchased from $2,200psf to $2,800psf depending on the sizes during launches.

I just wonder. What is wrong with this project? This is a freehold condo in District 9 leh. It has 2 facing. The main guard house is along Cairnhill Rise. The back is fronting Peck Hay Road. It is located in a quiet stretch of Cairnhill vicinity away from the traffic yet within walking distance to Newton MRT Station.

This is a mid-size development with 158 units mainly 2, 3, and 4 bedrooms. The units are fairly spacious with 2 bedrooms measuring 885 to 915sqf. You still have 2 bathrooms and an enclosed kitchen with a balcony. The 3 bedrooms are much bigger from 1,335sqf to 1,550sqf. With 3 bedrooms and 3 bathrooms. There is also both an enclosed and open-concept kitchen. Not too bad except for the bay window in the bedrooms which will have eaten up part of the usable floor area. Nevertheless, this condo come with a tennis court, elevated gym, BBQ area, and the usual swimming pool. This condo has full condo facilities. How can it be selling cheaper than OCR’s new condos?

If I break down the psf. They are currently trending at $2,500psf. A 1 bedroom start from $1.35 million. A 2 bedroom will fetch $2.3million and the more spacious 3 bedrooms that measure 1,335sqf at $3.4million. Are they expensive? Well, let me compare it against 2 recent new condos in the OCR area to have some perspective.

This new condo is located near to a “Orchard Road” shopping mall. A 1 bedroom is close to $1.5 million or $2,800psf. A typical 2 bedrooms costs $2 to $2.3 million with the psf around $2,600psf. 3 bedrooms from $3 to $3.2million or $2,500psf.

Here, let us compare them against another new condo in the OCR. The average psf is lower than $2,000 psf. A typical 1 bedroom will fetch $1.3 million. A 2 bedroom will fetch $1.7 million and 3 bedrooms from $2 million to 2.3 million.

I mean if you top up a little more. You can get the freehold The Vermont on Cairnhill which is only a 10-year-old condo right next to Orchard Road. How can you be wrong?

People ask you where you stay. Oh, I stay in District 9 in Orchard Road. Your friends will say wow. You make it leh. In reality, it is not very expensive to stay in town at its current valuation.

Here, my only concern is the price trend over the years. However, I think this condo and many other condos in the city area are overlooked. The poor performances so far are because those who bought directly from developers are losing money. However, this does not mean those who bought in the resale market will also lose money. If you enter at an attractive price point and wait for prices to bound back. I think you will be handsomely rewarded. Especially so if URA one day decides to remove the ABSD for foreigners. Confirm you will Huat all the way.

Conclusion

Some of you may not buy my argument. Many may also prefer a heartland address due to family and personal preference. Well. Please go ahead. However, for those who are more adventurous and prefer the convenience of a city location. Please explore your options around. There are many other condos in the Cairnhill, Paterson, to River Valley locations that are equally attractive. There is this very old condo but super huge like Cairnhill Plaza. Otherwise, if you prefer something newer, you can go for Urban Suites to Urban Resorts just behind Paragon.

Some of you here may also ask me what about 99 99-year resale condo along Orchard Road? Ayioh. I only have some advice for you. Most of your neighbors there drive Mercedes, BMW, Porche to Ferrari. How can you drive a Japanese or Korean car like me? How to fight? You get what I mean.

That’s all, I hope you have enjoyed this video. It is towards the end of the year and we looking forward to a brand new 2024. For those that do not have a good 2023. No worry. Work on your goals this coming new year. Make a yearly resolution. Take baby steps like I did for this channel. We all have to start somewhere. Sometimes we fall down. Sometimes we got hurt. But most importantly is to pick ourselves up and move forward again. Nothing is impossible.

With that. Happy New Year in advance to all my viewers and please continue to support me in 2024. You can refer to my other blog post – Property lobang in the Core Centre Region here.

Hopefully, I can create better content so that my videos can educate, enlighten, and empower you in your property journey. Thank you.